OTC-handeln med bitcoin ökar kraftigt – här är vår lösning

Feb 10, 2026

För privatpersoner och företag som vill handla större volymer bitcoin erbjuder BTCX en premium OTC-tjänst (over-the-counter). Det är ingen vanlig exchange upplevelse utan “white glove service” med professionellt och personligt stöd genom hela processen. I USA rekommenderar stora aktörer numera bitcoin som en del av en diversifierad portfölj. Och trenden syns inte bara där, även i grannlandet Norge visar analyser från K33 att stora institutionella investerare bygger exponering mot bitcoin. Bitcoin har helt enkelt blivit omöjlig att ignorera för den som vill ha en väldiversifierad portfölj. Vår OTC-lösning är compliant, säker och personlig Här är vad vi erbjuder: Reguljär och säker handel – All handel sker i full compliance med gällande regelverk. Direkt ägandeskap – Vi levererar bitcoin direkt till din wallet eller bankkonto. Personlig vägledning – Vårt team hjälper dig från första kontakt till slutförd transaktion, anpassat efter dina behov och önskemål. Direkt ägande med professionellt stöd Det finns bara 21 miljoner bitcoin. Punkt slut. Ingen centralbank kan trycka mer. Ingen stat kan devalvera dem.

Hej Bitcoinvänner!

Oct 24, 2025

Bitcoin-världen rör på sig både snabbt, positivt och globalt. Hos BTCX fortsätter vi bygga för framtiden: från årsstämman i Stockholm till nya samarbeten i Europa och med stark närvaro på höstens största Bitcoin-evenemang. Här är det senaste från oss i oktober och från några av kvinnorna som inspirerar i Bitcoin-rörelsen.

Bitcoin Hösten vi ser fram emot!

Oct 1, 2025

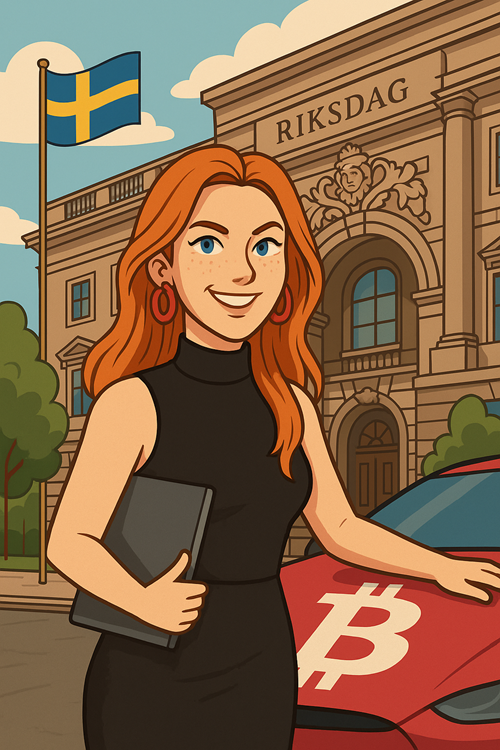

Vi startade hösten och september månad med Q1 rapport och två nya avsnitt av vår podcast “Women and Bitcoin”. I tillägg på det ökade vi vårt Bitcoin-innehav. Vi har även varit på besök i Riksdagen (igen) för att lobba för Bitcoin. Men sist av allt och definitivt störst! Vi lämnade in MiCA-ansökan. Det är vi väldigt stolta och glada över.

Bitcoinresan fortsätter tillsammans med er

Aug 22, 2025

Det händer mycket på BTCX just nu. I detta nyhetsbrev delar vi några av de senaste milstolparna på vår väg mot att bli Europas ledande publika Bitcoin Treasury-bolag. Läs om vår nya strategi, fördjupade samarbeten, och stark närvaro i det växande nordiska Bitcoin-communityt.

Goobit Group AB lanserar BTCX Bitcoin Treasury-strategi

Aug 4, 2025

Goobit Group AB (NGM: BTCX) (”Goobit” eller ”BTCX”) meddelar att bolaget implementerat en långsiktig Bitcoin Treasury-strategi. Första emissionsrundan är nu avslutad och nästa emissionsrunda inleds inom kort med målsättningen att maximera innehavet av bitcoin i balansräkningen.

BTCHEL 2025 – Nordens största Bitcoin-fest närmar sig!

Jul 24, 2025

Den 15–16 augusti 2025 samlas Bitcoin-communityt i Helsingfors för BTCHEL den allra första storskaliga Bitcoin-konferensen i Finland någonsin. Vi på BTCX kommer självklart att vara där, och vi hoppas att du också tar chansen att delta i vad som lovar att bli årets stora händelse för alla som tror på en friare, decentraliserad framtid.

BTCX Women & Bitcoin Podcast: Frihet, identitet och balans i en ny värld – med Fati Hakim

Jul 24, 2025

I vårt senaste poddavsnitt får du möta Fati Hakim, CEO och medgrundare av First Block, en Web3- och blockchainkonsultbyrå med rötterna i decentralisering, innovation och mänsklig frihet.