Nu är tiden att konsolidera den nordiska kryptomarknaden

Mar 5, 2026

Den nordiska kryptomarknaden står inför en avgörande fas. Efter nästan 15 år i branschen ser jag tydligare än någonsin att vi går in i en konsolideringsperiod. Därför meddelade vi nyligen att Goobit nu aktivt kommer att driva en strategi för sammanslagningar och partnerskap i Norden. Det är dags.

Vi Fortsätter Lyfta Bitcoin i Sverige!

Nov 26, 2025

November har kanske sett lugn ut på ytan, men bakom kulisserna har vi lagt grunden för viktiga steg framåt. Här på BTCX ser vi fram emot 2026! Det vi kan säga är att vårt fokus ligger där det alltid har legat: att stärka Bitcoin-ekosystemet, driva dialog med beslutsfattare och fortsätta utveckla produkter och tjänster som gör Bitcoin ännu enklare, tryggare och tillgängligt.

Hej Bitcoinvänner!

Oct 24, 2025

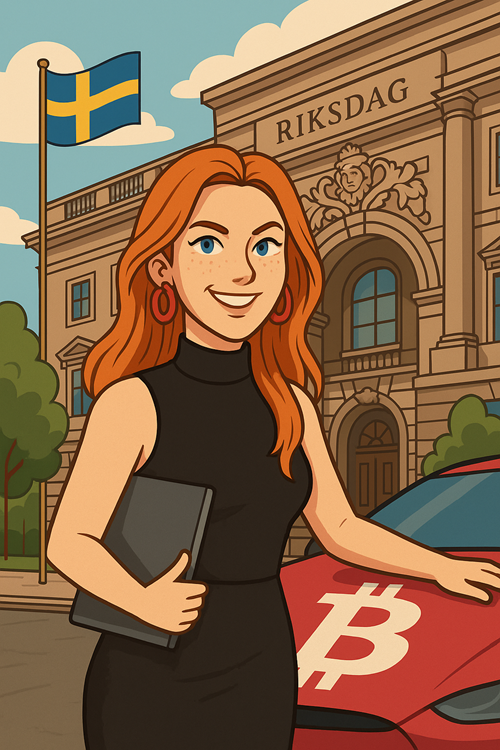

Bitcoin-världen rör på sig både snabbt, positivt och globalt. Hos BTCX fortsätter vi bygga för framtiden: från årsstämman i Stockholm till nya samarbeten i Europa och med stark närvaro på höstens största Bitcoin-evenemang. Här är det senaste från oss i oktober och från några av kvinnorna som inspirerar i Bitcoin-rörelsen.

Bitcoin Hösten vi ser fram emot!

Oct 1, 2025

Vi startade hösten och september månad med Q1 rapport och två nya avsnitt av vår podcast “Women and Bitcoin”. I tillägg på det ökade vi vårt Bitcoin-innehav. Vi har även varit på besök i Riksdagen (igen) för att lobba för Bitcoin. Men sist av allt och definitivt störst! Vi lämnade in MiCA-ansökan. Det är vi väldigt stolta och glada över.

Bitcoinresan fortsätter tillsammans med er

Aug 22, 2025

Det händer mycket på BTCX just nu. I detta nyhetsbrev delar vi några av de senaste milstolparna på vår väg mot att bli Europas ledande publika Bitcoin Treasury-bolag. Läs om vår nya strategi, fördjupade samarbeten, och stark närvaro i det växande nordiska Bitcoin-communityt.

Goobit Group AB lanserar BTCX Bitcoin Treasury-strategi

Aug 4, 2025

Goobit Group AB (NGM: BTCX) (”Goobit” eller ”BTCX”) meddelar att bolaget implementerat en långsiktig Bitcoin Treasury-strategi. Första emissionsrundan är nu avslutad och nästa emissionsrunda inleds inom kort med målsättningen att maximera innehavet av bitcoin i balansräkningen.

BTCHEL 2025 – Nordens största Bitcoin-fest närmar sig!

Jul 24, 2025

Den 15–16 augusti 2025 samlas Bitcoin-communityt i Helsingfors för BTCHEL den allra första storskaliga Bitcoin-konferensen i Finland någonsin. Vi på BTCX kommer självklart att vara där, och vi hoppas att du också tar chansen att delta i vad som lovar att bli årets stora händelse för alla som tror på en friare, decentraliserad framtid.