Jun 24, 2025

Från vardagskaos till scenen: Bitcoin for Busy Women på Nordic Blockchain Conference

Vilka dagar! Den 18–19 juni samlades framtidens röster på Nordic Blockchain Conference 2025 på Epicenter i Stockholm – och vi var såklart där!

Jun 24, 2025

Bitcoin tar plats i Almedalen – BTCX öppnar samtalet om framtidens pengar

Det är dags att få in Bitcoin i det politiska samtalet på riktigt. Och Almedalsveckan 2025 är ett perfekt tillfälle. BTCX:s grundare och VD Christian Ander deltar den här veckan i två viktiga panelsamtal som sätter fokus på framtidens penningsystem, konkurrens på finansmarknaden och - såklart - hur Bitcoin kan skapa en mer öppen, rättvis och inkluderande ekonomi.

Jun 24, 2025

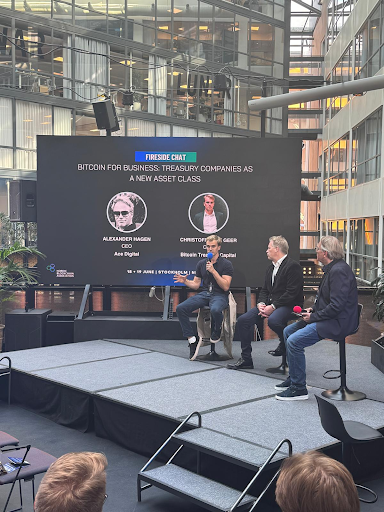

Bitcoin på balansräkningen – nu kliver Norden in i matchen

Fler och fler bolag världen över väljer att lägga Bitcoin på balansräkningen – och nu ser vi hur även Norden tar plats i denna globala rörelse. På Nordic Blockchain Conference i Stockholm 18–19 juni samlades nyckelpersoner för att diskutera framtiden för företags Bitcoin-reserver.

Jun 5, 2025

Bitcoin & Nationaldagen – en frihetsfråga för vår tid

För många är den 6 juni mest en röd dag i kalendern. En chans att vara ledig, kanske samla ihop vännerna för grillkväll eller hissa flaggan. Men vad hissar vi egentligen för? Vad symboliserar frihet i dag – i en tid där våra pengar, vår data och vår identitet blir allt mer digitala, centraliserade och kontrollerade?

Jun 4, 2025

14 år med BTCX – Från pionjärsajt till Sveriges äldsta Bitcoinbolag

Den 15 juni 2011 tryckte Christian Ander på “publicera” – ensam, omgiven av skeptiker och leenden som sa “lycka till med det där”. Men han hade en idé som inte släppte: att svenskar borde kunna köpa Bitcoin lika enkelt som de köper mjölk. Så föddes BTCX.

Jun 4, 2025

Bitcoin – framtidens pensionssparande?

Kryptovalutor som Bitcoin har länge betraktats som spekulativa investeringar. Men nu sker ett skifte: Bitcoin är på väg in i det finansiella finrummet, nämligen pensionssparandet.

May 22, 2025

Bitcoin Pizza Day – en tugga som förändrade världen

Varje år den 22 maj firar Bitcoin-communityt en ikonisk händelse som inte bara mättade en hunger – utan också satte Bitcoin på kartan som en verklig valuta. Bitcoin Pizza Day är inte bara en dag för att äta pizza. Det är en symbol för innovation, framtidstro och människors vilja att pröva något helt nytt.

May 21, 2025

Bitcoin i fokus när New York vill bli krypto-vänligt

Den 20 maj hölls New York Citys första kryptotoppmöte på det anrika Gracie Mansion, där stadens borgmästare Eric Adams tillsammans med dess CTO Matthew Fraser samlade branschprofiler och innovatörer för att diskutera framtiden för digitala tillgångar i staden som aldrig sover. Det är ett tydligt tecken: även traditionella makthavare på New Yorks högsta politiska nivå tar nu krypto på allvar - särskilt Bitcoin.

May 19, 2025

Metaplanet stärker sin Bitcoinstrategi

Det Tokyo-baserade investeringsbolaget Metaplanet, ofta kallat Japans svar på MicroStrategy, fortsätter att göra vågor i Bitcoinvärlden. Bolaget, som under 2024 beslutade att göra Bitcoin till en strategisk reservtillgång, har snabbt blivit ett av de mest uppmärksammade institutionella namnen i Asien inom krypto. Den 19 maj meddelade Metaplanet att de köpt ytterligare 1 004 BTC, till ett värde av cirka 104,3 miljoner USD – deras näst största enskilda köp hittills. Med detta ökar deras totala innehav till 7 800 BTC, motsvarande över 800 miljoner USD i dagens värde.

May 8, 2025

BTCX på Bitcoin FilmFest

Bitcoin möter film i ett unikt kulturellt evenemang – och BTCX är självklart på plats. Mellan den 22–25 maj går Bitcoin FilmFest av stapeln i Warszawa, Polen. Ett måste för alla som vill kombinera sitt intresse för bitcoin med film, konst och nätverkande. Dessutom har vi fixat en exklusiv rabattkod för våra nyhetsbrevsprenumeranter!