You sell your winners too soon

2013-11-09

Jana Vembunarayanan / October 16, 2013

Recently I read an excellent article from Prof. Sanjay Bakshi that appeared in Outlook Business. In this article he writes about the reasons for paying up for quality business like Nestle India. From 1981 to till date this stock returned 32% per annum.

At this rate of compounding Rs 1,000

invested in this stock would have become Rs 54,67,538.72 after 31 years. Your initial investment got multiplied by 5467 times. But there is one problem. Most of us would have sold the stock after it doubled or tripled in value. We sell our winners too early.

In March 2000 the NASDAQ Composite index hit a peak of 5048.62. In Oct 2002 the index fell to 1139.90 losing 77% of its value from its peak. Even after 13+ years the index did not come back to its peak value. Even now there are several people who are holding on to the tech stocks purchased during the peak of the bubble hoping to break even. We hold our losers for a very long time.

Why do we sell winners early and hold on to losers?

I was able to answer this question after reading Thinking Fast and Slow by Daniel Kahneman

Consider these two problems

Problem 1: Which do you chose?

Get $900 for sure OR 90% chance to get $1,000

Problem 2: Which do you chose?

Lose $900 for sure OR 90% chance to lose $1,000

Think for a minute before reading further. For problem 1 most of us will chose the option of getting $900 for sure. We avoid risk when a sure gain is at sight. For problem 2 most of us will chose the option of 90% chance to lose $1,000. When a loss is looming around we chose to gamble and seek risk.

You were probably risk averse in problem 1, as it is the great majority of people. The subjective value of a gain $900 is certainly more than 90% of the value of a gain of $1,000. Now examine your preference in problem 2. If you are like most other people, you chose the gamble in this question. The explanation for this risk seeking choice is the mirror image of the explanation of risk aversion in problem 1: the (negative) value of losing $900 is much more than 90% of the (negative) value of losing $1,000. The sure loss is very aversive, and this drives you to take the risk.

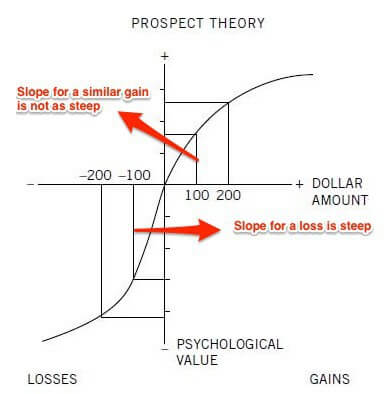

The image given below shows the psychological value we associate with gains and losses.

You can clearly see from the above graph that the slope(pain) for losing $100 is much greater than the slope(joy) of gaining $100. The response to loss is stronger than the response to corresponding gains. This is called as loss aversion. We go to extreme extents to avoid a loss.

When directly compared or weighted against each other, loses loom larger than gains. This asymmetry between the power of positive and negative expectations or experiences has an evolutionary history. Organisms that treat threats as more urgent than opportunities have a better chance to survive and reproduce.

If we apply the above principle to stocks we get.

2. When the stock goes down in value we lose money only when we sell it. Hence in order to avoid the pain and accept the mistake we hold on it. We convince ourselves that paper loss is not real loss. We wait for it to come back to our original purchase price. We seek risk to avoid loss and hence hold the losers.

Disposition Effect

Now consider the following question

You need money to cover the costs of your daughter’s wedding and will have to sell some stock. You remember the price at which you bought each stock and can identify it as a “winner,” currently worth more than you paid for it, or as a loser. Among the stocks you own, Blueberry Tiles is a winner; if you sell it today you will have achieved a gain of $5,000. You hold an equal investment in Tiffany Motors, which is currently worth $5,000 less than you paid for it. The value of both stocks has been stable in recent weeks. Which are you more likely to sell?

Most people chose to sell Blueberry Tiles. One of the main reason for this is we like winning more than losing. Also we have a mental account for each stock that is in our portfolio and we want to close every account with a gain. We keep an internal score for each stock. Instead of looking at the overall portfolio performance we look to gain from every stock. This narrow framing is called as disposition effect and it leads to selling winners and holding losers.

If the problem is framed as a choice between giving yourself pleasure and causing yourself pain, you will certainly sell Blueberry Tiles and enjoy your investment prowess. As might be expected, finance research has documented a massive preference for selling winners rather than losers – a bias that has been given an opaque label: the disposition effect.

Four-fold Pattern

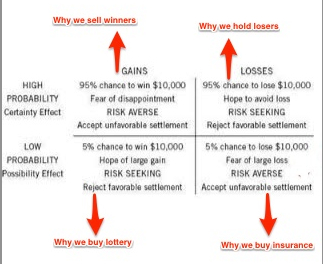

To summarize all this Daniel Kahneman came up with a pattern called as the four-fold pattern. Spend some time to go through the image in detail.

The top left quadrant is when we are risk averse. This is what makes us to sell winners. The top right quadrant is were we seek risk. This is what makes us to hold losers.

The top left quadrant is when we are risk averse. This is what makes us to sell winners. The top right quadrant is were we seek risk. This is what makes us to hold losers.

From all this I have concluded that very few people would have held on to Nestle India from 1981 to till date. Rest of us would have sold it when the stock doubled or tripled and will be bragging our stock picking skills to friends and family.

Ready to start your Bitcoin journey?

BTCX is Sweden's first Bitcoin exchange. With us, you can buy bitcoin quickly and securely. Experience safety and simplicity when investing in the currency of the future!