Bitcoin's Latest Price Updates and Market Analysis - June 2024

2024-06-20

Bitcoin continues to fascinate investors and enthusiasts with its price increases and significant market developments. In June 2024, Bitcoin's price has seen notable changes, driven by various factors such as market sentiment and institutional investments. This article examines the latest events and underlying trends shaping the current Bitcoin market.

Current Price Overview

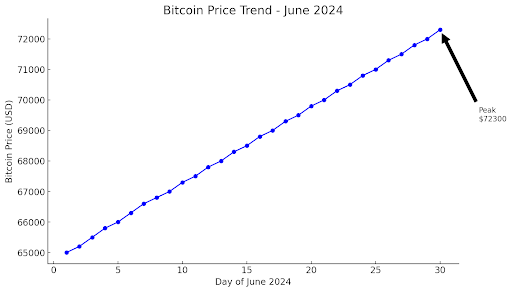

In mid-June 2024, Bitcoin is trading at approximately $69,020. This marks a significant increase of about 9.26% over the past month and an impressive rise of 60.51% since the beginning of the year. The recent price surge can be attributed to several key developments within the Bitcoin ecosystem.

Market Drivers

Institutional Investments and ETF Inflows: Institutional interest in Bitcoin remains strong, with significant investments flowing into Bitcoin ETFs (Exchange Traded Funds). Despite a temporary decline in net inflows during the recent halving week, with a negative net inflow of $398 million, the overall trend is positive. These ETFs hold over 835,000 BTC, worth approximately $53.5 billion, which represents 4.24% of the current Bitcoin supply.

Bitcoin Halving: The 2024 Bitcoin halving has been a focal point for market analysts and investors. Historically, halving events - where the reward for mining new Bitcoin blocks is halved - have led to significant price increases due to reduced supply. Analysts predict that if Bitcoin can maintain its current momentum and break through key resistance levels at $70,000 and $71,600, we may see rapid price increases towards $80,000 or even higher.

Market Sentiment and Social Media: Sentiment analysis shows a mixed but largely positive view on social media platforms. Bitcoin ranks as the third most discussed cryptocurrency, with a sentiment score of 3.1 out of 5. Positive tweets account for 41.22% of all mentions, indicating a cautiously optimistic sentiment among the crypto community.

Energy Consumption and Sustainability: Bitcoin's energy consumption continues to be a topic of debate. New estimates show that 40-75% of Bitcoin mining uses renewable energy sources. This shift towards sustainability is crucial as it addresses one of the major criticisms against Bitcoin and improves its appeal to environmentally conscious investors.

Technical Analysis

From a technical perspective, Bitcoin's price development has been closely monitored by analysts. Currently, Bitcoin is trading above $63,600, after falling 5.6% on the weekly chart. However, the overall trend remains positive with significant potential for further gains. Analysts point out that if Bitcoin can break the resistance at $65,000, it could quickly rise to new heights, potentially reaching $80,000, $90,000, or even $100,000.

Future Outlook

The future outlook for Bitcoin remains positive, driven by strong fundamentals and increasing institutional adoption. The coming months will be crucial as the market adjusts to the effects of the halving and responds to broader economic trends. With Bitcoin increasingly seen as a hedge against inflation and political instability, its role as a store of value is further strengthened.

In summary, Bitcoin's recent price movements and market developments underscore its evolving nature and enduring appeal. Investors should stay informed about ongoing trends and be prepared for potential volatility as the market navigates these turbulent times.

Ready to start your Bitcoin journey?

BTCX is Sweden's first Bitcoin exchange. With us, you can buy bitcoin quickly and securely. Experience safety and simplicity when investing in the currency of the future!