Historical Weakness in September

2024-09-03

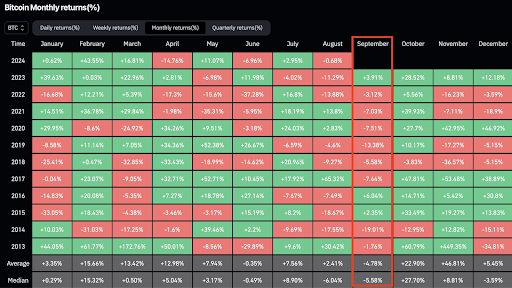

Historically, September has been a weak month for Bitcoin, with an average negative return of around -5.36% over the past ten years. Many analysts believe that this seasonal trend may be due to a combination of factors, including lower trading volumes due to summer vacations and the market's cautious stance ahead of important economic events that often occur in the fall. Traders and investors tend to hold back their activities during this period, which can result in decreased demand and increased volatility. The uncertainty surrounding upcoming macroeconomic decisions and events often amplifies this effect.

In September 2024, the situation is no different. Bitcoin has experienced noticeable volatility and a price decline during the first weeks of the month, which has recently led to the price falling below 60,000 USD. Several analysts have pointed out that this trend may continue until some of the major economic decisions and announcements are made public. For investors hoping for a market rebound, it is therefore crucial to keep an eye on specific events that could have a direct impact on the price of Bitcoin.

Factors Affecting the Market

FOMC Meeting and Interest Rate Cuts:

One of the most closely watched events is the Federal Open Market Committee (FOMC) meeting, where the Federal Reserve is expected to give signals about potential interest rate cuts. The U.S. central bank is expected to lower rates in mid-September, which could stimulate markets by reducing borrowing costs and increasing liquidity. Historically, Bitcoin has tended to perform well during periods of monetary easing as it is seen as an asset that can protect against inflation. If the Federal Reserve decides to lower rates, this could potentially lead to an increase in Bitcoin's price as investors seek returns in alternative assets.Binance and Regulatory Uncertainty:

Uncertainty surrounding potential regulatory actions against Binance, one of the largest cryptocurrency exchanges in the world, and its founder Changpeng Zhao, continues to create concern in the market. The U.S. Securities and Exchange Commission (SEC) and other global regulatory authorities have increased their scrutiny of Binance, which could potentially impact the market. Although no specific sanctions have been announced yet, there is concern among investors that regulatory action could create a domino effect that affects the entire cryptocurrency market, including Bitcoin.

A Long-Term Hedge Against Inflation

It’s easy to get distracted by the short-term volatility in Bitcoin’s price, but it’s important to remember the long-term positive trend. Time and again, Bitcoin has demonstrated its strength as a deflationary currency, where the real value lies in its decentralized and democratic nature, as well as its limited supply. Instead of focusing on daily price movements, at BTCX we like to view Bitcoin as a long-term hedge against inflation and a powerful opportunity to participate in a global financial revolution.

Ready to start your Bitcoin journey?

BTCX is Sweden's first Bitcoin exchange. With us, you can buy bitcoin quickly and securely. Experience safety and simplicity when investing in the currency of the future!