Bitcoin on the Balance Sheet – Now the Nordics Join the Game

2025-06-24

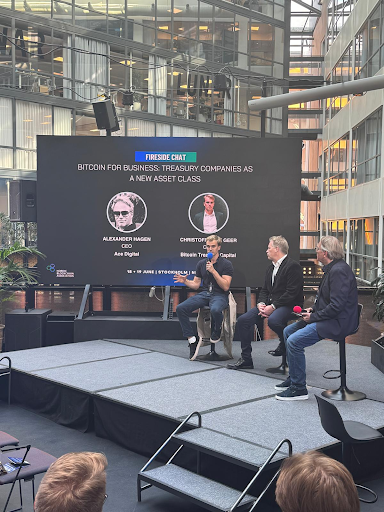

More and more companies around the world are choosing to add Bitcoin to their balance sheets — and now we’re seeing the Nordics step into this global movement. At the Nordic Blockchain Conference in Stockholm on June 18–19, key players gathered to discuss the future of corporate Bitcoin reserves.

Among the speakers were Alexander Hagen, CEO of Norway-based Ace Digital, and Christoffer De Geer, founder of Sweden’s Bitcoin Treasury Capital. Both companies recently went public with their Bitcoin strategies — and the market responded. Since the announcements, shares in both companies have risen. It's a clear signal that the market is beginning to value transparency and long-term thinking in an increasingly uncertain economic climate.

Globally, MicroStrategy — now simply called Strategy — has led the way. With outspoken Bitcoin advocate Michael Saylor at the helm, the company has accumulated a Bitcoin reserve that represents over 1% of the total BTC supply. Their strategy is clear: Bitcoin is not speculation — it’s a safeguard against inflation and currency debasement.

BTCX – An Early Believer in Long-Term Bitcoin Strategy

But for BTCX, this is nothing new. As Sweden’s oldest Bitcoin company, founded in 2011, BTCX has always viewed Bitcoin as a strategic asset. Holding Bitcoin on the balance sheet has never been about hype or trend — but a natural extension of our belief in an open, decentralized financial system.

“Holding Bitcoin as a reserve asset is, for us, an obvious part of a sound and sustainable financial strategy. This isn’t about speculation — it’s about principles, transparency, and being prepared for the future,” says Christian Ander, founder and CEO of BTCX.

Why Bitcoin on the Balance Sheet?

When companies allocate part of their liquidity to Bitcoin, it reflects a range of strategic goals:

Inflation protection – Bitcoin is a deflationary asset with a fixed supply (21 million)

Global recognition – Bitcoin is the most decentralized and resilient digital asset

Financial independence – Companies reduce reliance on old banks, currencies, and national regulations

The fact that more Nordic companies are now joining this trend shows that Bitcoin is no longer a fringe issue — it’s a strategic consideration for the future of business.

Ready to start your Bitcoin journey?

BTCX is Sweden's first Bitcoin exchange. With us, you can buy bitcoin quickly and securely. Experience safety and simplicity when investing in the currency of the future!