Money 3.0: How Bitcoins May Change the Global Economy

2013-10-16

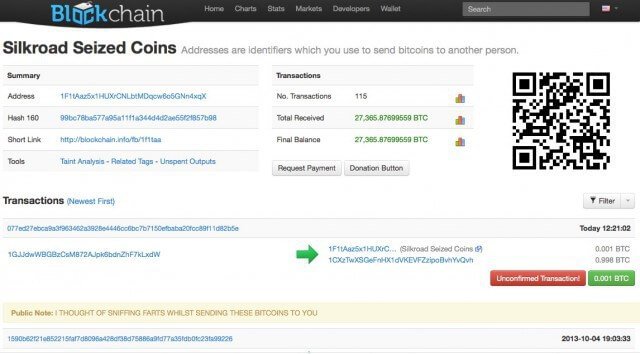

Despite shutdown of an illicit Internet marketplace, virtual currency blooms

After the feds seized and shuttered Silk Road, an online marketplace for illegal drugs, earlier this month, some technology experts started sounding the death knell for Bitcoin, Silk Road’s international currency of choice.Instead, we may soon see Bitcoin’s real value.

Timothy Carmody for National Geographic

Published October 14, 2013

Invented in 2008, Bitcoin is not the first attempt at an all-digital, cryptographically based currency. Others have existed in one form or another for nearly fifty years, but have either failed to take off or dramatically crashed and burned. Bitcoin is the first cryptocurrency with the deep structure, wide adoption, and trading momentum to achieve escape velocity.

Despite shutdown of an illicit Internet marketplace, virtual currency blooms.

In practice, Bitcoin blends credit cards’ ease of digital transfer with the relative anonymity of a cash handoff. Like all currencies, the problems it poses are both practical and metaphysical; like cash or credit, Bitcoin is somehow both more and less real than the goods it is traded for.

Until now, the most well-known of these goods have been illegal drugs, like those on Silk Road. But the drug marketplace’s shutdown gives Bitcoin a chance to gain some much-needed legitimacy. “It’s a watershed moment for Bitcoin,” Marco Santori, the chairman of the regulatory-affairs committee of the Bitcoin Foundation, told The New Yorker . “Bitcoin’s PR problem, with which it has struggled for the last year or so, is being addressed in a very direct way.”

Bitcoin’s future potential was a hot topic this week at emTech, an MIT conference on emerging technologies. In a panel hosted by MIT Technology Review’s Tom Simonite, MIT economist David Johnson and BitPay CEO Stephen Pair discussed Bitcoin’s complex relationship with paper currencies, credit, and state authority.

Johnson noted that buyers and sellers, banks and governments all care deeply about what money is used for. Money’s use carries associations of value, which in turn helps establish whether a currency, a payment form, and a social model for transactions are legitimate. “It’s hard to bring any of them on board if the money is associated with behaviors consumers are troubled by,” Johnson said at emTech.

“The key to the legitimacy of the system for all of these parties is to establish that people using the system are acting legally and responsibly.”

In turn, Pair denied that Silk Road’s association with Bitcoin would prove fatal to the cryptocurrency. “Silk Road used a lot of technologies. First, it used the Internet. It also used Tor [a network using “onion routing” relays to conceal a user’s location identity] for anonymity. And then it used Bitcoin for payments,” said Pair. Silk Road’s shutdown “shows that just because you use Bitcoin doesn’t mean you can evade law enforcement.”

If until now, Bitcoin has been a notorious outlier, this is its chance to redefine itself as a mainstream contender.

What is Bitcoin For?

If it’s not to move drugs or launder money, what is Bitcoin for?

Let’s assume that the Silk Road arrests halt or at least slow Bitcoin’s use at the fringes of the law, at least until those actors tighten up and regroup (and law enforcement does the same). Let’s further stipulate that the number of people interested in Bitcoin as an academic exercise or as an ideological argument about fiat currencies has (like the total number of Bitcoins itself) a hard upper limit.

Pair and Johnson both argue that Bitcoin still has tremendous potential doing what it was built to do: transfer money from person to person without stopping for national borders or rent-seeking middlemen. Those people can be investors, merchants, and even migrant workers, all participating in one of the largest, strangest, but most elegant exchanges the world has ever seen.

Bitcoin’s Origins

Bitcoin’s invention is attributed to Satoshi Nakamoto, a pseudonym for a person or group who, apart from a 2008 paper introducing Bitcoin , have remained anonymous and absent, a virtual author.

Bitcoin is backed by no government, and its value isn’t rooted in precious metals.Instead, it’s distributed across the entire network of users, its roots in complex digital mathematics. Bitcoin supporters say that this makes the currency immune to manipulation by politicians or oligarchs seeking to move its value up or down for politics or profit.

“Bitcoin’s integrity is guaranteed by the rules of math and the laws of physics,” Pair says. Such rhetoric is common in the world of digital currency, where reverence for Bitcoin has succeeded gold for many hard-money enthusiasts.They’ve entered into an uneasy and unusual alliance with anarcho-technologists who distrust government authority and believe in the power of distributed networks and open-source software.

With governments’ financial and credit troubles in turn causing major problems for their currencies, global investors are looking for something firmer than the promise of a central bank. In September, Tyler and Cameron Winklevoss—Facebook bridesmaids turned Bitcoin entrepreneurs— touted the digital currency as a solution to the world’s troubled currency markets. “It’s Gold 2.0,” Tyler Winklevoss said.

Like gold or other precious metals used as specie, Bitcoins are scarce. But their scarcity is algorithmic, as opposed to natural or accidental.

New Bitcoins are added only by being “mined,” in the high-tech equivalent of a land rush. Computers on the Bitcoin network race to solve increasingly complicated mathematical problems. The first to do so has its solution verified by the other nodes on the network. Once verified, the Bitcoin can be traded using Bitcoin’s wallet software.

Bitcoin mining guarantees a fixed rate of inflation (relative to itself). It roots the value of Bitcoins in the work needed to solve the puzzle. And the decentralized proof-of-work consensus protocol guards against fraud and counterfeit.

In Pair’s words, Bitcoin “commoditized the process of securing the network.” All the work done by financial centers and payment systems to detect fraud or counterfeit for traditional currency and credit markets is done all along the network according to the peer-to-peer protocols for Bitcoin. And the costs of that work are likewise distributed throughout the system, paid for through Bitcoin mining. This is what lets Bitcoins be traded and exchanged without huge fees.

There are a little over 11.78 million bitcoins in circulation, with a total capitalization of 1.6 billion USD, and typically somewhere between 50,000 and 70,000 bitcoin transactions each day. As more and more computers participate in bitcoin mining—daily unique bitcoin addresses reached a high of over 100,000 this summer—and the mathematical problems needed to earn new bitcoins have grown more complicated, the average operating margin for miners has plummeted. Mining has switched from being a frontier gold rush to a relatively mainstream, industrial-grade operation.

Digital Currency’s Future

Today, essentially every digital transaction and every international transaction involves a use of one form or another of virtual currency or credit.

Transaction and exchange fees, taxes, and payment delays exist to provide short-term credit, guard against counterfeit, excessive withdrawals and other kinds of fraud, and to extract income. Bitcoin is designed to provide the same security guarantees and convenience of credit, while foregoing its extra processing times and fees.

You settle with Bitcoin immediately, just like cash. Unlike a credit card exchange, where your credit card number and security information are handed over completely for any transaction, a transfer is authorized only to pay a specific amount.

In principle, Bitcoin’s independence makes it more stable than traditional currencies like dollars or euros. In reality, its value has fluctuated wildly over its four-year-existence.

Today, the price of one Bitcoin has stabilized at about $140 US; it briefly dipped down to $121 USD after Silk Road’s shutdown, but quickly rallied back. But just a year ago, the price of a Bitcoin seemed stable at about $12 USD. Those are some wild swings.

The exchange values matter, both to people who mine or invest in Bitcoins and to users who want to use them for everyday goods and services, which are usually denominated in local currency. (Local currency is also used to pay taxes, which Bitcoin transactions sometimes try to avoid.)

But what Bitcoin also does is make digital payments possible for people who not only don’t have PayPal, but don’t have a functioning credit system. In many parts of Africa, Latin America, and south Asia, most people have no access to credit or digital payments; with Bitcoin, that infrastructure comes for free.

Pair’s company, BitPay, converts Bitcoins back and forth into various local currencies without charging a transaction fee. (Instead, it charges a flat monthly rate.) Its clients include hosting companies, computer and electronic equipment companies, and companies that sell internationally.

“With Bitcoin, you can take an international payment with no risk of credit card fraud,” says Pair. “We sometimes forget that there are many countries where you can’t take a credit card payment. Those countries become isolated from the rest of the Internet economy… For many of these countries, if this payment system works, if the US and Congress can support and tolerate a reputable, well-paid industry, this will be a big connector to the world economy.”

The area with the biggest potential for Bitcoin worldwide is probably international remittances: money sent home by workers living abroad. Currently, this money has to be handled by several intermediaries: banks, wire services, and currency exchanges all take their cut. A recent report by Businessweek noted that the average fee for remittances was 9 percent of the money transferred, with conversion to cash often costing an extra 5 percent. Western Union’s profit margins are enormous for an intermediary, nearly 16 percent, and most of its costs are devoted to the technologies moving money from one place to another, guaranteeing the legitimacy of the transfer. In short, Western Union spends and earns billions to do what Bitcoin does for free.

Instead of Western Union, migrant workers (or businesses operating on their behalf) could use Bitcoin to send payments from one country to another through email, without worry of fraud or needing to support an elaborate exchange or credit market.

It would be real-time, immediate settlement at a fraction of the cost. In ten years, instead of international drugs, Bitcoin could act as a genuine lingua franca for international work.

“The vast majority of the planet don’t even own a bank account,” Bitcoin evangelist Jonathan Mohan tells PBS Newshour . “And it’s my contention that—and a lot of people think this—that, just as in Africa, they didn’t go to phones. They went directly to cell phones, that, in the same sort of adoption curve, in these developing nations, you’re not going to see them start getting bank accounts. You’re going to see them just going straight to Bitcoins, because if you own a Bitcoin address, you have a bank account on your phone that you can interact on the global stage with.”

There are still real problems. Johnson thinks that Bitcoin has yet to suffer its first genuine crisis of legitimacy, and its proponents haven’t developed a political strategy to reassure wary states and investors that the currency can play nice.And the rhetoric of many Bitcoin proponents assumes a sophisticated understanding of its underlying technology that is far from widespread, especially among the world’s poor.

Investors and miners can debate the nuances of different cryptographic schema, but for most of us, money is ultimately an article of faith.

Money 3.0

It seems inevitable that money, already virtual, will only become more so as we shift into a digital economy.

“Money has become data,” Ben Milne, founder of Dwolla, a real-time payments company, said at emTech. “There needs to be an infrastructure that allows people to exchange whatever they have for whatever they want, that confirms who they are, and confirms that the transaction is legitimate.”

He notes that while today, credit cards handle trillions of dollars in transactions, ACH’s virtual transfers where no physical money changes hands handle tens of trillions. If digital companies or currencies can make these transactions more secure, more efficient, and more immediate, that can unlock value for everyone, even some of the companies that currently benefit from the high barrier of entry to traditional banking.

And Bitcoin can still affect the world economy even if it does not become a currency that everyone uses or understands. “If Bitcoin becomes widespread, respected, and legitimate, that pressures everyone—all the central banks and banking companies—to bring down those costs in order to stay competitive,” Johnson says. “Or everyone could just use Bitcoin,” adds Pair.

Källa:

https://news.nationalgeographic.com/news/2013/10/131014-bitcoins-silk-road-virtual-currencies-internet-money/

Ready to start your Bitcoin journey?

BTCX is Sweden's first Bitcoin exchange. With us, you can buy bitcoin quickly and securely. Experience safety and simplicity when investing in the currency of the future!