We Continue to Lift Bitcoin in Sweden!

Nov 26, 2025

November may have seemed quiet on the surface, but behind the scenes we've laid the groundwork for important steps forward. Here at BTCX, we're looking forward to 2026! What we can say is that our focus remains where it has always been: strengthening the Bitcoin ecosystem, driving dialogue with decision-makers and continuing to develop products and services that make Bitcoin even simpler, safer and more accessible.

Michael Saylor burns over 17,000 bitcoin

Apr 1, 2025

Michael Saylor, arguably the biggest name in the Bitcoin world, has done it again. In a recent interview with CoinDesk, he revealed in classic Saylor fashion, a mix of brilliance and subtle frustration over the world’s inability to “get it” that he has burned the keys to more than 17,000 BTC. Yes, you read that right. Seventeen thousand bitcoin, gone forever. Or…?

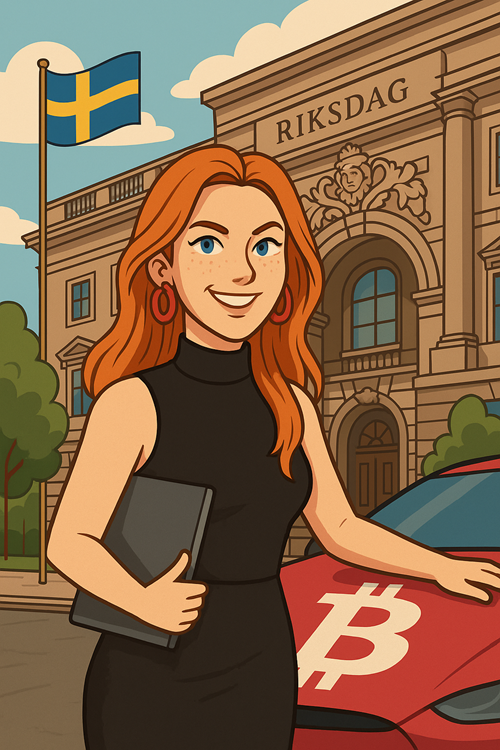

BTCX in the Swedish Parliament

Mar 27, 2025

“Sweden risks falling behind - it’s time to act.” That was the central message as Blockchain Sweden hosted a seminar in the Swedish Parliament this week, invited by Member of Parliament Oliver Rosengren. The topic: Is Sweden lagging in blockchain development, and what can we do about it?

The Digital Euro and Bitcoin – Freedom or Control?

Mar 21, 2025

It’s now becoming reality. The European Central Bank (ECB) has set a deadline to launch the digital euro in October 2025. Christine Lagarde and the ECB claim this is a natural development of our financial system - a way to future-proof the euro in an increasingly digital world. But what does it actually mean - and why are many people skeptical?

The U.S. Strategic Bitcoin Reserve – A Historic Shift That Could Transform the Market

Mar 11, 2025

On March 6, 2025, President Trump signed an executive order to establish a national Bitcoin reserve and a digital asset stockpile. The goal is to strengthen the United States' economic resilience and reduce reliance on traditional financial systems.

Interview with Mariana Burenstam Linder - A Pioneer in Finance and Bitcoin

Mar 6, 2025

Bitcoin is transforming the financial world – yet women remain underrepresented. BTCX interviews Mariana Burenstam Linder, a pioneer in finance, on why more women should get involved.

Why Swedish women need to wake up

Mar 4, 2025

On International Women's Day, we celebrate women's progress and rights – but how free are we really when it comes to our finances? In Sweden, we have access to bank accounts, loans, and pensions, but all within a system we do not control.

Get Started Now!

You can buy and sell bitcoin as soon as your information is verified!

Create an account